Stockbrokers Still Cheat Investors Even as SEBI Tightens Rules, for 15 Years Now

Ganesh Anupindi is a stock investor who had an account with Kotak Securities. According to him, a relationship manager of Kotak called on him and orally promised a return of around Rs50,000-Rs100,000 per month by selling the call & put options on Nifty. He explained to him that that the positions are hedged and therefore there is nil or negligible risk. Mr Anupindi claims to have told them that he does not understand and is not comfortable with trading in futures and options (F&O) at his age (59 years). He was a retired person without a job and totally dependent on his investment portfolio of Rs1.25 crore in 93 scrips.

Kotak opened an F&O account in December 2019 and showed him some profits and losses across different transactions. “I told them I cannot accept any loss at my age and with my lack of employment these are the funds for our family’s future,” says Mr Anupindi. He also requested them to share weekly statements and take all precautions to protect his hard-earned capital, saved up by living a frugal life and making a lot of sacrifices.

Mr Anupindi repeatedly pleaded with them to inform him of the profit or loss. When he saw a loss of Rs84,000, he asserted that he cannot bear a trading loss and was assured that this loss would be made good.

Mr Anupindi was clueless about terms such as VAR (value at risk), option position, size, strike price, premium, etc. Eventually, on the 18th March, he realised he had a position in Nifty futures which was bleeding him. To make up for the loss, he was asked to sell his investment portfolio. In the evening on 18th March, when Mr Anupindi checked the ledger, statements and the accounts, he was shocked to find that he was liable to pay more than Rs83 lakh.

It turned out that the positions Kotak Securities had put on for him led to a further loss of Rs49 lakh. Further, that Mr Anupindi was made to lose Rs62.16 lakh in just three trades in options of 27th February, 5th March and 12th March. Among the shares of Mr Anupindi that got sold off were Hindustan Unilever, Asian Paints, Pidilite, Dabur, etc. A 59-year old was cheated of his life’s savings.

Moneylife reached out to Kotak for their response but they have not responded to our mail till the time the article got published. As and when we hear from them we will add it to our article.

Mr Anupindi is not alone. Not a month goes by without Moneylife getting emails from investors complaining about how they have been ruined by some unscrupulous stockbroker. It could be an unknown name like Modex, a known regional name like BMA or a well-known brand name like Kotak Securities or Motilal Oswal or Karvy, which manage to ‘lose’ crores of rupees of hard-earned money of upper middle-class people.

In each case, it is the same pattern: get a power of attorney (PoA) from the investor (because of a stringent Securities and Exchange Board of India (SEBI) rule that forces a broker to deliver shares sold within two days of trading) and misuse the PoA to indulge in massive over-trading of Futures and Options (F&Os). Additionally, in some cases of egregious fraud, brokers have helped themselves to customers’ shares, having run up huge losses while trading on their own account.

Here is a most recent case. On 30th April, SEBI issued an ex-parte order against a Delhi-based broker Modex International which is suspected to have misappropriated almost Rs100 crore of a clients’ money.

Modex International is a trading member with the National Stock Exchange (NSE) and BSE and is also a depository participant of Central Depository Services Limited (CDSL).

As a part of its offsite supervision, NSE observed mismatches between the security balances reported by Modex in its monthly and weekly client securities balances submitted on 29 November 2019 with the depository participant and clearing members’ submissions/holdings with the Clearing Corporation.

NSE then ordered an inspection for the period from 1 March 2019 to 11 December 2019, which revealed that Modex has posted journal vouchers/manual adjustment entries in ledgers/register of securities (RoS) of clients. NSE suspected that Modex had perhaps misappropriated clients’ securities, and so it ordered a forensic audit for the period 1 April 2017 to 24 January 2020.

The audit determined that Modex had recorded incorrect entries in the backoffice register of securities, which resulted in the misrepresentation of the security balances. To establish the correct balances as on 24 January 2020, the auditors reversed the adjustment entries and computed the corrected securities holdings.

The auditors found that while Modex supposedly held Rs 186.72 crore of client securities, only Rs 104.24 crore was actually available with it, leading to a shortfall of Rs95.29 crore. It was also noted that the broker had misused the clients’ funds.

The NSE report noted that Modex misappropriated securities and funds through the following modus operandi. It had collected investments (securities/funds) from certain clients with a commitment of periodic payment as returns on their investment.

Modex invested its funds/securities in the futures and options (F&O) segment that led to large losses. Since Modex had collected investments from the clients on periodic payment commitment, it could not recover the F&O losses from them. Modex met its exchange obligations by selling off clients’ securities through 10 accounts connected to the promoters. In all, NSE found that Modex had misappropriated Rs136.29 crore of funds.

The investigation also found a variety of other violations such as misrepresentation of books and accounts that included incorrect adjustments in RoS, incorrect entries of payments and receipts of clients, incorrect adjustment in client’s financial ledgers etc.

On the basis of the forensic report, NSE submitted its report to SEBI. “The findings of the NSE report indicate that there has been misuse of clients’ funds and securities by the MISL and therefore MSIL has been found to be in prima facie violation of… provision of law,” SEBI said.

This included violation of stock brokers’ norm and portfolio managers’ rules among others. It further noted that these directors are also liable for the prima facie violations found to have been committed by Modex.

Hence, SEBI issued an interim order, restraining the directors Dharmendra Kumar Arora, Pavan Kumar Sachdeva, Ajay Jain, Parminder Singh Kindra, Sanjay Mohan Uniyal, Sarika Chawla, Sharda Gupta, Vikram Duggal and Suresh Agarwal from accessing the securities market, from buying, selling or otherwise dealing in securities, or being associated with the securities market.

They have also been asked to desist from undertaking any activity in the securities market. They have been asked not to dispose of or alienate any assets or to create or invoke or release any interest or charge in any of such assets except with prior permission of NSE and BSE. They have been asked to provide a full inventory of all their assets.

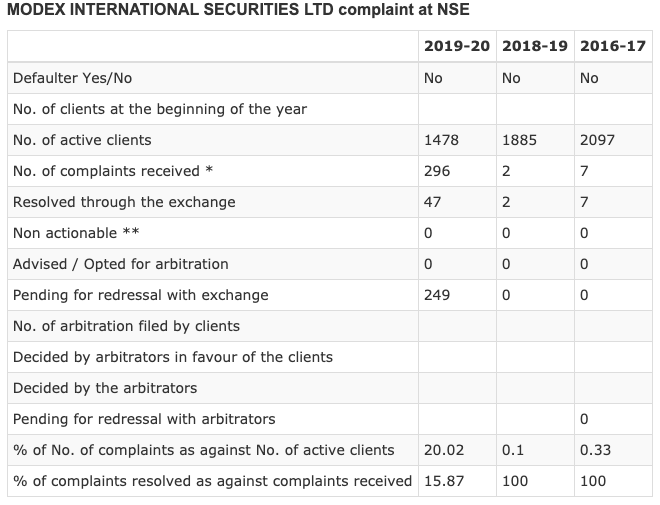

From the tables below (for Modex), we can see how the number of clients has been reducing and complaints surging up in the last financial year.

The Rs2,300 Crore Karvy Scam

In November 2019, Karvy uauthorisedly transferred securities worth Rs2,300 crore of more than 95,000 clients, into its account, by misusing the PoA given by its clients.

On 22nd November, SEBI barred Karvy from taking new clients in respect of its stock broking activities and also prevented it from using the PoA given by clients after the broker was found to have allegedly misused clients’ securities. Karvy had, instead of pledging its own shares, pledged shares belonging to clients and utilised them to raise funds. Some of these funds were, in turn, transferred to its sister concerns such as Karvy Realty Ltd.

Grievance System Loaded against the Investor

People like Mr Anupindi have a hard time recovering the money or getting any kind of redress. SEBI and the exchanges normally push the aggrieved investors towards arbitration where the arbitrators go strictly by the book. The brokers safeguard themselves well in advance by getting the investors to sign legal documents such as PoY, while all the promises they make are oral.

In the arbitration, most investors lose—unless, of course, they are like Dilip Modi, a Moneylife reader who had documented everything and could win his case and his money. You can read his story here.

Here is another harrowing story of an aggrieved small investor Wing Commander (Retd) CR Mohan Raj whose life savings got wiped out at Motilal Oswal. He won in consumer courts but SEBI took the brokers’ side despite clear grounds of fraud and forgery.

In the first week of December 2019, soon after the Karvy scandal, NSE had issued an advisory communication asking investors to be careful while executing PoA with stockbrokers and the need to specify all the rights that brokers can exercise on their behalf. But these advisories are meaningless. Moneylife has been battling the one-sided power of attorney (PoA) documents that clients are forced to sign since M Damodaran’s stint as SEBI chairman. We have seen significant positive changes over the years, but they are still one-sided.

Until recently, most brokers did not require any special permission from clients to further pledge their shares as they already held the PoA for the demat accounts. It is this PoA that was being misused by brokers. The cases involving Karvy and certain other brokers who took their clients’ shares through this PoA are cases in point.

In February 2020, SEBI set up a new process for brokers to take shares as margin from clients. From 1 June 2020, shares of clients lying in demat accounts with brokers will have to be specifically marked ‘shares pledged for the purpose of margin’. So far, the practice did not require any such specific pledge and merely shares lying in clients’ demat accounts held by brokers were considered for the purpose of margin.

The entire process of investigation and grievance redress is not only loaded in favour of the broker, but is also time consuming and frustrating. Almost all investors lose steam and cannot recover their lost money, not even from the Investor Protection Fund of the stock exchanges.

The losses inflicted by brokers on investors is so common and the redress process is so frustrating that the SEBI Bhavan at Bandra Kurla Complex in Mumbai came under siege when a crowd of 40-50 stock market investors blocked the main entrance of the building in December 2019. The investors said they were protesting against SEBI’s slow action against a broker BMA Wealth Kreators.

Although the broker was suspended by National Stock Exchange (NSE) in October 2019, it had not been declared a defaulter. Had it been declared a defaulter, clients would have been to claim money from the exchange Investor Protection Fund (IPF).

Eventually in February 2020, National Stock Exchange (NSE) declared three stock brokers—Vrise Securities, Kaynet Finance and BMA Wealth Kreators—as defaulters for non-compliance with the regulatory provisions of the bourse.

Not just BMA, thousands of investors have lost money in recent years in Amrapali Aadya Trading and Investments, Kassa Finvest, Unicorn, Vasanti Securities, Royal International, Click2Trade, Allied Financial Services , Ficus Securities and Fairwealth. Some of the brokers are also said to have diverted client funds, like Modex is alleged to have done.

The trading terminals of Fairwealth Securities and BMA Wealth have been disabled by BSE and NSE. BMA was found to have misappropriated client money worth around Rs100 crore, while the management of Fairwealth Securities has been inaccessible to regulators, and has failed to file its weekly compliance report, according to a report in the Hindu BusinessLine.

Two years ago, SEBI had received more than 4,000 complaints against Kassa. A probe revealed that Kassa used client margin money to fund its associate companies including Sinia Global (registered in Singapore), Mystic Cures (a spa in Mehrauli) and Midas Global Fund (a mutual fund registered in Singapore).

Ray of Hope

Interestingly, in a judgement in November 2019, the arbitration appeal bench of NSE asked CD Equisearch Pvt Ltd. a stockbroker to pay Rs136,000 including interest to client Dr Suwarna Chodhary because it was ruled to be illegal to close out client’s open position without intimation and permission. A sharebroker normally closes out client’s open position without intimation and permission when client margin deposit gets wiped out due to sudden fall or rise in shares value.

C.D Equisearch Pvt Ltd had sold out client’s open buying position in Maruti Ltd. & Canara Bank on 21 September 2018 due to a sudden collapse of share prices around 1pm. The client was losing his entire deposit/ margin amount with the broker.

According to Adv Bhalchandra M Ganu, “Brokers have to strictly adhere to the rules, regulations and bye-laws of the stock exchange… In terms of Regulation 3.10 of National Stock Exchange, the broker will have to inform their client of the short fall in margin calculated at the end of the day. And even after intimation/ notice if the client fails to pay additional margin as levied by the broker the next day, then the broker can sell off the client’s open position, otherwise not.”

The bench has observed that, “For all practical purposes as well as considering the due compliance with the provision of regulation 3.10(b), the respondent was required to demand the short fall and was obliged to wait till the next trading day. Had the appellant failed to shore up the daily settlement on 22 September 2018, then it would have been proper and justifiable for the respondent to close out”.

In a similar case, the Bombay High Court has ruled in favour of the client and has ruled against Bonanza Portfolio Ltd, in August 2019, when the same issue under regulation 3.10 came up before the High Court.

Default Settlement Rules of Exchanges Lack Clarity

There is a lot of confusion over the new criteria of stock exchanges with regard to the settlement of investor claims against defaulting brokers.

A public notice by the National Stock Exchange (NSE) on 14 January 2020, in the context of a defaulting broker, mentioned that there would be a cap or limit per member for settling claims from the Investor Protection Fund (IPF).

However, in a subsequent notice issued in February, the NSE did not mention any such criteria. While the January circular of the NSE said the deadline for filing claims had been set at three months, the February circular said claims would be accepted for six months.

Between November 2019 and February 2020, the exchange has issued a number of public notices with regard to brokers, including Allied Financial Services, Fairwealth, BMA and VRISE. Each of these notices has set different criteria, which did not find mention in the latest notice issued in February.

Investors complain about this lack of clarity saying if there is a cap per broker member in settling investor claims, it is restrictive. NSE also said that claims against defaulters have to be filed within three months against two or three years earlier. Since brokers are members of the exchange, which is responsible for due diligence and regulations, investors are allowed to claim money from the IPF maintained by a particular exchange.

Earlier there were no restrictions at the NSE on claims that can be made against a member who has been declared a defaulter. There was only a cap of Rs25 lakh per investor. NSE has Rs549 crore in its Investor Protection Fund Corpus now and BSE had Rs728 crore on March 2019.

NSE’S Advisory Note:

• Ensure that pay-out of funds/securities is received in your account within 1 working day from the date of pay-out.

• Be careful while executing the PoA – specify all the rights that the stock broker can exercise and timeframe for which PoA is valid. It may be noted that PoA is not a mandatory requirement as per SEBI / Exchanges.

• Register for online applications, viz., Speed-e and Easiest provided by depositories for online delivery of securities as an alternative to PoA.

• Ensure that you receive contract notes within 24 hours of your trades and statement of account at least once in a quarter from your stock broker

• Please note that securities provided by you towards the margin are not permitted to be pledged by your stock broker for raising funds.

• If you have opted for a running account, please ensure that the stock broker settles your account regularly and in any case not later than 90 days (or 30 days if you have opted for 30 days’ settlement).

• Do not keep funds and securities idle with the stock broker. • Regularly login into your account to verify balances and verify the demat statement received from depositories for correctness.

• Check messages sent by exchanges on a monthly basis regarding funds and securities balances reported by the trading member and immediately raise a concern if you notice a discrepancy.

• Always keep your contact details viz mobile number / email ID updated with the stock broker. You may take up the matter with stock broker / exchange if you are not receiving the messages from exchange / depositories regularly.

• If you observe any discrepancies in your account or settlements, immediately take it up with your stock broker and if the stock broker does not respond, with the Exchange/Depositories

Here are some dos and don’ts shared by NSE on their portal. Moneylife has written about how to safeguard against these kinds of frauds.