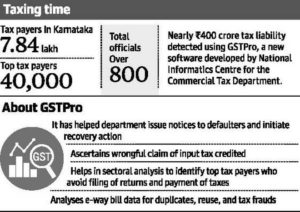

New software detects GST defaulters with tax liability of nearly ₹400 crore

Among them are 500 ‘top tax payers’ from hotel, telecom and services industry

Analysis of data after the Goods and Services Tax (GST) regime was implemented in July last year in the State has led to the detection of nearly ₹400 crore of unpaid taxes. Among the defaulters are “top tax payers”.

This tax liability came to light in March and April this year after data was analysed using a new software — GSTPro system — developed in-house by the National Informatics Centre, Karnataka, in collaboration with the Commercial Tax Department, as large sets of post-GST data was available with the department.

Since then, of the nearly ₹400 crore unpaid tax, ₹150 crore has been collected. About 500 top defaulters alone have ₹234 crore tax liability, and these defaulters include those from the hotel industry, telecom, and services.

“We have issued notices to defaulters; and in some cases, bank accounts have been attached too,” Commercial Tax Commissioner M.S. Srikar told The Hindu. Top 40,000 dealers, who bring in close to 80% of the revenue are being constantly monitored, he said, adding that the new software will not only enhance revenue collection, but will also help in widening the tax payers’ base. “The new process throws up data and ultimately officials have to use it to increase tax compliance and collection.”

He said the department has been analysing data (retrospectively since July 1) over the last two to three months. Initially, it was tough to identify defaulters since there was confusion about filing returns among the dealers, coupled with technical glitches.

The implementation of new software has not only eased assessment of defaulters, but also enables matching of data retrieved from multiple sources, which was not possible earlier. For example, by matching monthly returns and e-way bills, tax officials found that some dealers who had raised e-way bills had not filed their monthly returns. “Such detections will help improve compliance rate as it quickly spreads through word of mouth and dealers will know that they are being tracked for any violations,” Mr. Srikar said.

Meanwhile, the department is categorising dealers to capture available sectoral trends.

This will not only help track sectoral performance, but also help officials monitor company’s filing returns. The data analysis has also shown that many companies are using input tax credits for payment of tax.

Source : Click Here