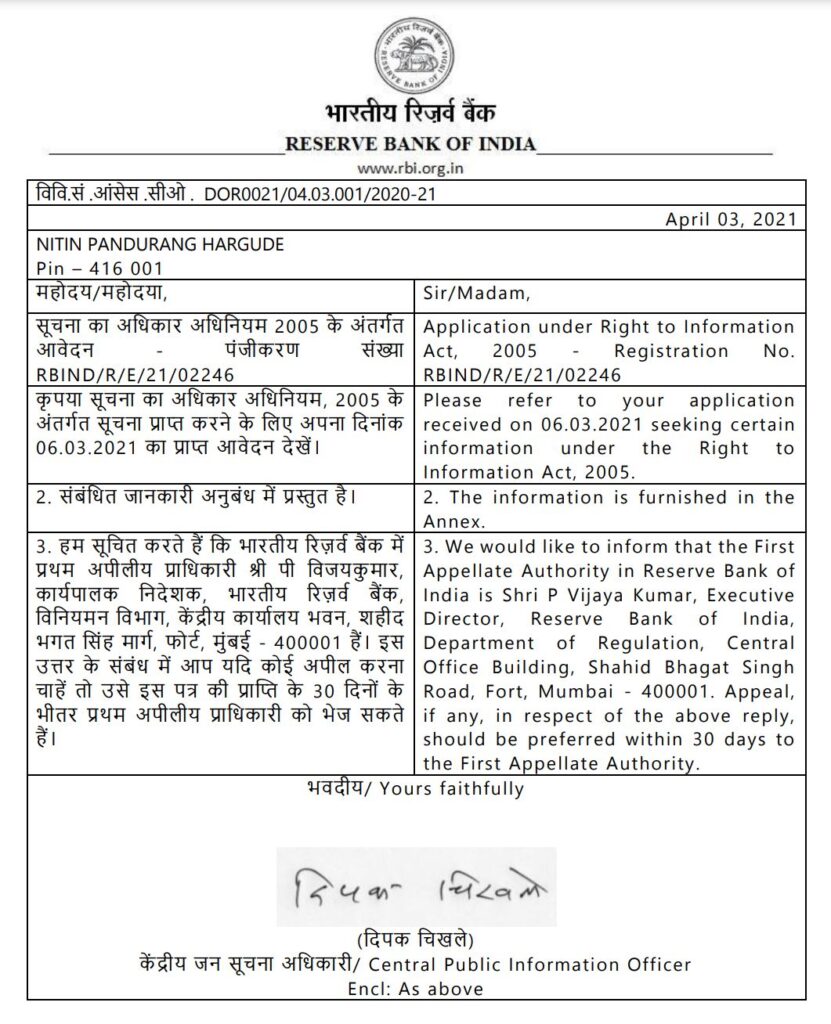

RBI ON RTI QUERY RELATING TO ATTESTATION BY A CHARTERED ACCOUNTANT FOR LOAN APPROVAL

RBI replied that there are No specific instructions issued with regards to Signing on Project Report for Loan Purposes or for certification/ Signing on Unaudited balance sheets and on Income Tax Returns of Clients (for those who dont fall under category of Audit Cases such as Income Tax, Company Act etc.)

However, the reply mentioned that credit related issues are mostly deregulated. RBI has advised banks to have documents of investment policy, loan policy, loan recovery policy etc. prepared and duly vetted by their Boards of Directors. Banks are required to take credit related decisions based on Board approved policies subject to the instructions contained in our Master Circular on “Loans and Advances – Statutory and Other Restrictions” issued vide DBR. No.Dir.BC.10/13.03.00/2015-16 dated July 1, 2015 which is available on RBI’s website under the head ‘Notifications’.

Secondly, on the query that whether if there was any policy drafted by RBI with such Banks to get Certificate of Know your customer by CA if client is known to him and validity of the same. The Bank clarified that no specific instructions are issued in this regard.