I-T dept withdraws 1,072 appeals from HC, appellate tribunals

The cases were dismissed on the basis of a recent circular issued by CBDT on August 8, 2019, raising the threshold for filing cases in ITAT from Rs.20 lakh to Rs.50 lakh, retrospectively.

The Income Tax department of Tamil Nadu and Puducherry has withdrawn 1,072 appeal cases from Madras High Court and Income Tax appellate tribunals (ITAT) after Central Board of Direct Taxes issued a circular raising the threshold of filing cases in ITAT, High Court and Supreme Court.

The cases were dismissed on the basis of a recent circular issued by CBDT on August 8, 2019, raising the threshold for filing cases in ITAT from Rs.20 lakh to Rs.50 lakh, retrospectively. Similarly, in high courts, the limit has been doubled to Rs.1 crore and in case of Supreme Court, the revised limit for filing appeal has been increased from Rs.1 crore to Rs.2 crore.

The entire exercise of withdrawal of cases, on the basis of an order issued on August 8 for enhancement of monetary limits for filing of appeals in tribunals (ITAT) and courts (HC and Supreme Court), is stipulated to be completed by October. The Income Tax department sources told Express that Tamil Nadu has four benches and all are situated in Chennai and cater to the entire Tamil Nadu and Puducherry region. The number of department appeals pending before ITAT benches and High Court is approximately 1565 and 4,187, respectively.

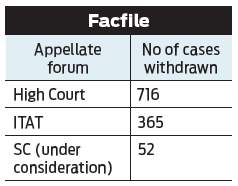

“We have withdrawn 1,072 cases and these include 716 from High Court and 356 from ITAT. We have also identified 52 cases for withdrawal from Supreme court wherein the office in New Delhi has to take the call,” officials said.

This comes after the PMO sought an update from the CBDT about the number of appeals it has withdrawn from various courts. The issue of litigation between the tax department and the taxpayers is being constantly monitored by the PMO.

Sources said the revised limits will help “to reduce taxpayer grievances and help the department focus on litigation involving complex legal issues and high tax effect.” It will help in time, effort and resources to focus on litigation of substantial value.