IEC Code not required for Import/Export under GST Regime – PAN/GSTIN shall work as New IEC Code Number

Another step has been taken by the government of India for ease of doing business. Now, no IEC code shall be required for Import/Export, as decided by the government via notification.

As a result, the importer/exporters need NOT apply for separate IEC code for import/Export in India. As per the latest trade circular by the DGFT, the PAN shall be construed as new IEC code for the purpose of import and export and the DGFT department shall also issue the new IEC code as your PAN number only.

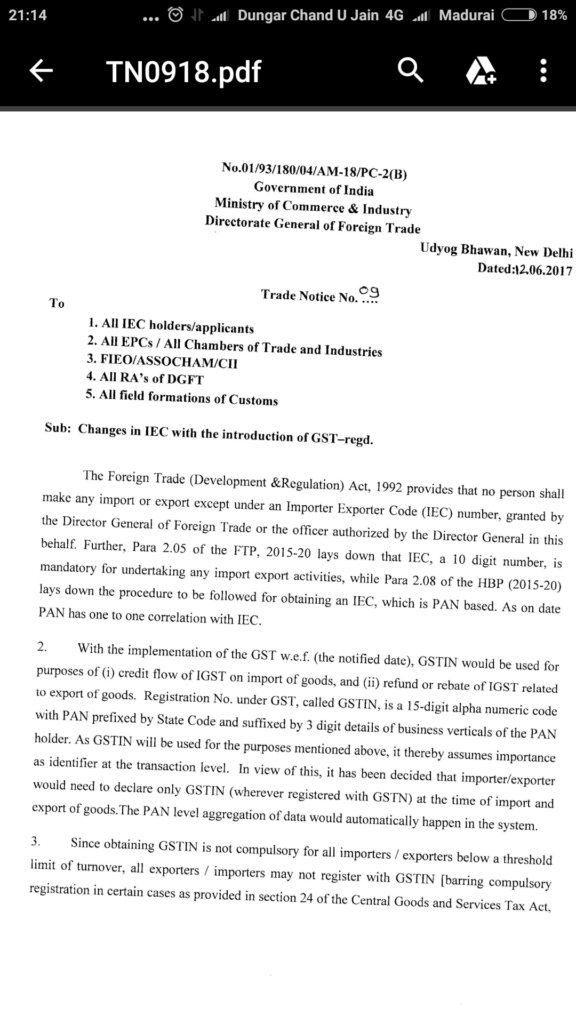

Let us read and understand the trade notice in detail:

What is IEC Code? Why IEC code in required?

IEC code means Import Export Code. As per the Foreign Trade Policy (FTP) in India, every importer and exporter is required to get IEC code to start Import export from India. Without IEC code, no importer and exporter are authorised to do import export business.

What is the change? Why IEC code not required under GST?

As per the trade circular, there are two kinds of categories to be dealt with:

1. Person registered under GST

2. Person not registered under GST

Let us deal with it one by one:

IEC Code for Person Registered under GST

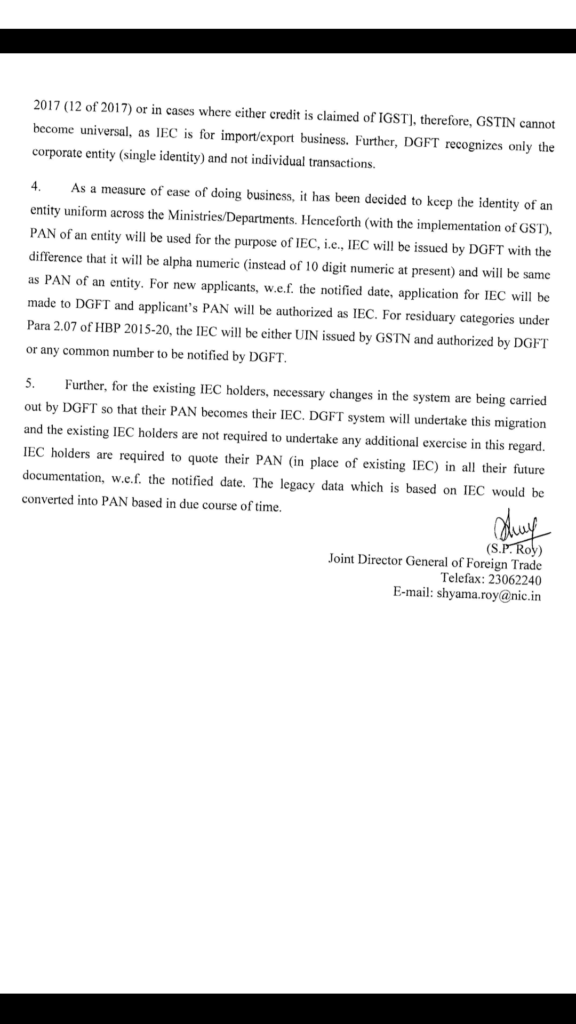

As per the Trade circular, if you are registered for GST, then GSTIN number may be used for the purpose of import and export in India. However, to maintain uniformity, the department has agreed that PAN should be used as a IEC number and not the GSTIN number. Also, for new applicants, the application shall be sent to DGFT department and the department shall issue the IEC number as your PAN number only.

Further, the existing IEC holder, the department is making required changes to the system so that the PAN number can be accepted as the IEC code.

IEC Code for Person not registered under GST

For persons who are not required to register under GST, the PAN number shall work as a IEC code. Further, for all new applicants who are not required to register under GST, the application shall be made to DGFT and applicant’s PAN will be authorised as IEC.

Status of Existing IEC holder

The DGFT is taking the responsibility to make necessary changes in the system so that the PAN of existing IEC holder will become their new IEC code.