Accused splurged on clothes, electronics, shoes, 4-wheelers, jet-setting across globe

During the course of investigation, led by Assistant Commissioner of Police (Wadala division) Santosh Walke, the police found that Nabarun Majumder was made the head of the credit card section in Mumbai in 2012.

While Nabarun Majumder withdrew Rs 85 lakh in cash from his four credit cards, he also swiped the cards for Rs 1.99 crore in the last six years, the officer added.

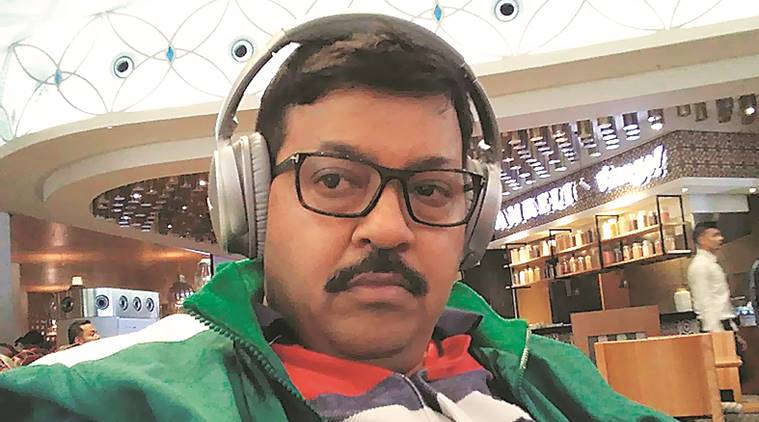

THE REAY Road Union Bank of India’s (UBI) credit card repayment section head, who was arrested last week for allegedly making nearly Rs 3 crore by rigging the system, splurged on shopping for clothes, shoes, electronics and four-wheelers and jet-setting across the world, including multiple trips to his hometown Kolkata.

All along, however, Nabarun Majumder (49) continued paying his monthly installments for the Rs 15-lakh home loan that he has taken from the same bank to maintain the facade of normalcy. The bank started an internal probe in October, last year, after a top official found four credit cards, which had crossed their credit limits, in Majumder’s name.

“While going through the transactions made by him using the four credit cards, it has come to light that he has spent around Rs 60 lakh alone on clothes and shoes. In his statement to the police, he claimed to have also purchased a mobile system for Rs 3.6 lakh, a music system worth Rs 5 lakh and a computer for Rs 3 lakh. He also purchased a Maruti S-Cross car for Rs 15 lakh recently,” said a senior police officer.

“On several occasions, he has flown to Kolkata, where his family resides, and returned to Mumbai the same day. There are some international visits as well.” While Majumder withdrew Rs 85 lakh in cash from his four credit cards, he also swiped the cards for Rs 1.99 crore in the last six years, the officer added.

During the course of investigation, led by Assistant Commissioner of Police (Wadala division) Santosh Walke, the police found that Majumder was made the head of the credit card section in Mumbai in 2012. Whatever payments are made using a credit card are collected by the bank and sent to a vendor that ensures that transactions above the credit limit are not authorised. Accordingly, after card holders paid their card bills, it was Majumder’s job to email the file to the vendor so that it could be updated on the system.

“This file had an editable format and Majumder had access to it. This gave him the idea to rig the process. He took four credit cards from his bank and increased their collective credit limit to Rs 18 lakh. He then kept editing the payments’ file and added his name to the list of people who had made payments. He would add Rs 3 to Rs 4 lakh in the amount paid column,” an officer said. Between March 15, 2012 to July 21, 2018, he is alleged to have used up Rs 2.84 crore using these four cards.

It was in 2018 that a top UBI official found that the four credit cards had been allowed transactions way beyond their original authorised limit. When he found that all the cards were in the name of the employee heading the credit card division of their bank, he smelt a rat.

“It was found that Majumder had made illegal transactions and was suspended. The bank then filed a complaint with us, following which, we registered an FIR on December 20,” ACP Walke said.

Over the past two months, Majumder has lost over 10 kg. He was admitted to the KEM hospital on Tuesday after he complained of chest pain. When contacted, officials at UBI’s Reay Road branch said they were not authorised to comment on the matter.