In Mumbai, ex-business honcho loses Rs 25 crore to phone tricksters posing as police, CBI officers

MUMBAI: In one of the biggest cyber fraud cases targeting an individual in the city, a retired MNC director lost nearly Rs 25 crore to WhatsApp callers who said she was being probed in a money laundering case. Police said she sold her and her mother’s shares, mutual fund investments, and even took a gold loan to pay the accused.

The complainant, a senior citizen from the western suburbs, said that on Feb 6, she received a call from the “telecom department” that her three mobile numbers would be deactivated. When she asked for the reason, she was connected to a “police officer”, who said they have received a money laundering complaint and her phone numbers and Aadhaar were found linked to the case. The “police officer” then transferred the call to a “CBI officer”.The cyber crime police probing a fraud case wherein a former director of a corporate firm lost nearly Rs 25 crore have frozen 31 bank accounts. The fraud took place between Feb 6 and April 3.

The complainant, a senior citizen from the western suburbs, said WhatsApp callers told her phone numbers and Aadhaar card were found linked to a a money-laundering case. The “police officer” transferred the call to a “CBI officer” who introduced himself as special officer Rajesh Mishra. He told her that the cop who spoke to her earlier was Pradeep Sawant, INS Cyber. Mishra sent his and Sawant’s IDs on her WhatsApp number, the FIR stated.

Mishra told the complainant that her bank account and Aadhaar card had been sold in China and there was money laundering of Rs 6.8 crore. When she denied any involvement, Mishra told her that since she was a senior citizen, he would not call her to the police station. He further told her that it appeared that she was innocent and therefore, he would help her.

Mishra told her that an FIR was registered against her, and he was probing the case. He sent her photographs of some of the “accused” for identification. She said she didn’t know any of them. Mishra instructed her not to discuss the case with anyone and told her that she could not travel out of Maharashtra without his permission.

Mishra then sent her a letter on WhatsApp, instructing her to send money to a “secret bank account” and if she failed to do it, she would have to pay Rs 1 lakh fine and face three years’ jail. She panicked and transferred Rs 15.9 lakh. On Feb 9, Mishra called her again and claimed that RBI had issued instructions to freeze her bank account. He asked her to redeem her mutual funds and transfer money to her account. He then instructed her to open a current account. When she refused, he opened one and told her to transfer money into it, claiming that it would be sent to RBI.

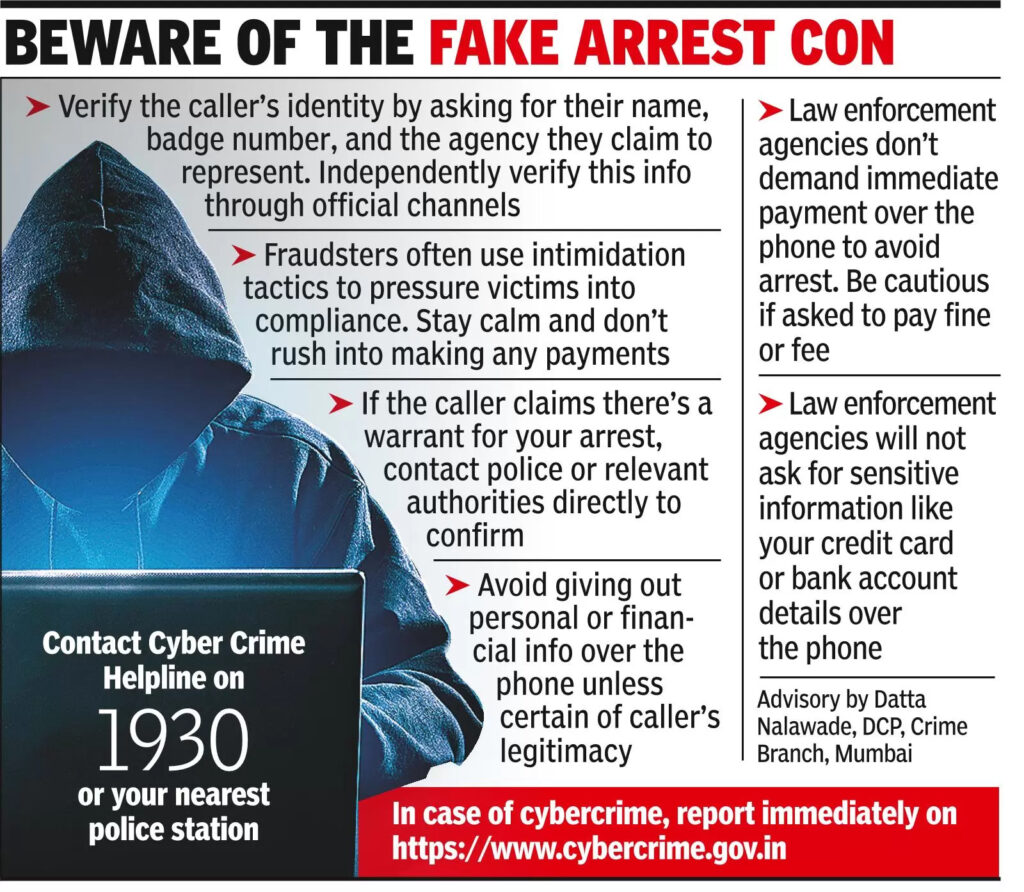

Mishra then told her to transfer Rs 5.7 crore to generate a “white fund”. She sold her shares and sent the money. Later, on his instructions, she took a gold loan and sent Rs 11.5 lakh. He also asked her to generate and transfer Rs 70 lakh as “white fund”. For this, she sold her mother’s shares. On April 3, Mishra told her that the case was closed and she could collect RBI’s receipt from Andheri police station. It was when she reached the police station that realised she had been cheated. Cyber crime police registered an FIR on April 10. A team supervised by joint commissioner of police (crime) Lakhmi Gautam and DCP Datta Nalawade, and led by senior inspector Datta Chavan is probing the case.