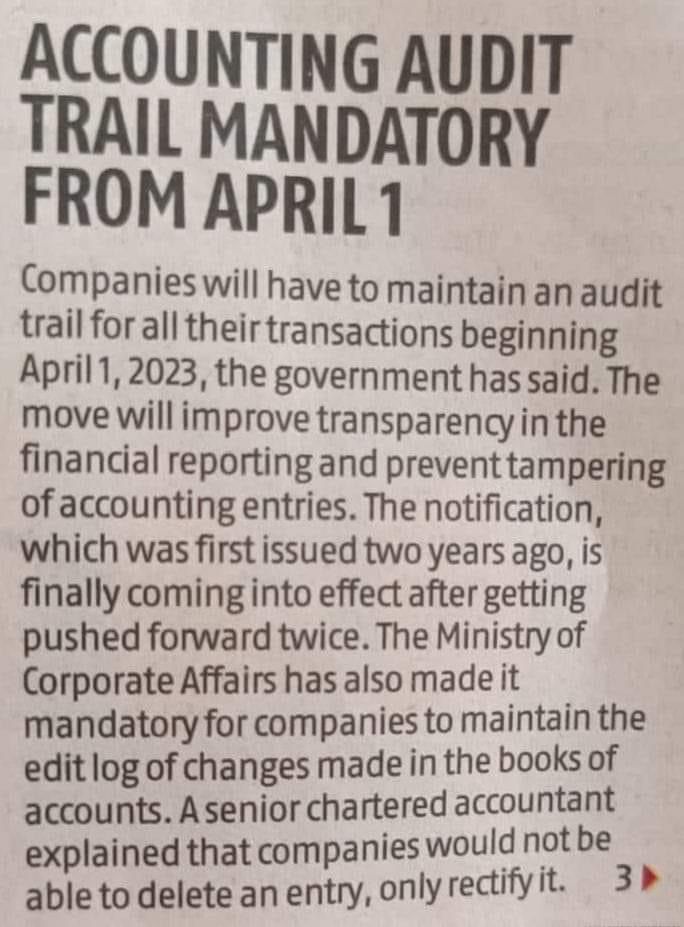

MAJOR CHANGE IN AUDIT TRAIL REQUIREMENTS: ACCOUNTING SOFTWARE WITH EDIT LOGS TO BE USED FROM APRIL 1

The Ministry of Corporate Affairs (MCA) through three notifications had notified that every company using accounting software must use software that records an audit trail of each and every transaction and creates an edit log of each change made in the books of account. The software must also ensure that the audit trail cannot be disabled.

The Ministry of Corporate Affairs (MCA) issued the three notifications, No. G.S.R. 205(E) dated 24.03.2021, G.S.R. 247(E) dated 01.04.2021 & G.S.R. 235(E) dated 31.03.2022, regarding the use of accounting software by companies for maintaining their books of account.

By the notification dated March 31, 2022, in the proviso to sub-rule (1) of rule 3, for the figures, letters and words “1st day of April, 2022”, the figures, letters and words “1st day of April, 2023” was substituted. In short, moving the effective date of implementation of the same to 1st April of this year.

According to the notifications, every company using accounting software must use software that records an audit trail of each and every transaction and creates an edit log of each change made in the books of account. The software must also ensure that the audit trail cannot be disabled.

In response to the notifications, auditors have commented that the trail should include deleted transactions as well. They have also stated that they need to amend their audit programs and internal control checks accordingly. If any deviation is found, it needs to be reported in their reporting.

These notifications are aimed at ensuring transparency and accountability in the financial sector. The use of accounting software with audit trail features will help prevent financial fraud and ensure that companies are maintaining accurate records.

The provisions make a major amendment to the Companies (Accounts) Rules, 2014. The stakeholders are requested to migrate to or ensure that the accounting software used by the company meets the above requirements with effect from April 1, 2023.