Share transfers to turn costlier from January next year

All transactions done on stock exchanges will have same stamp duty rates across the country

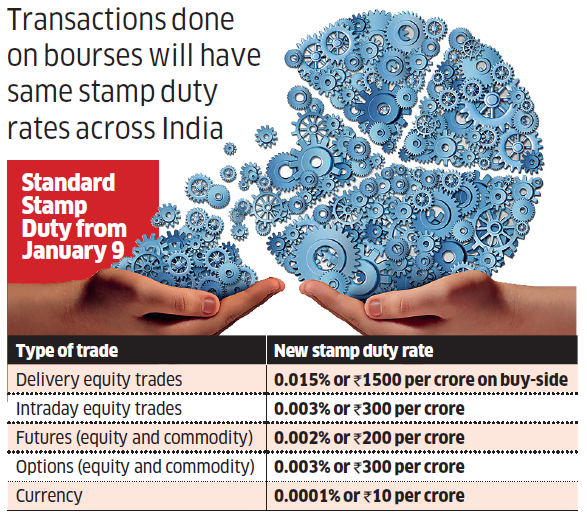

The cost of transferring shares from one account to another — including off-market trades — is set to go up from next year. A finance ministry notification on Tuesday said various such transactions will now attract stamp duty from January 9. Also, all transactions done on stock exchanges will have the same stamp duty rates across the country.

Till now, off-market share transactions were not subjected to this tax. Various states collected stamp duty at different rates. In the Union Budget on February 5, the government announced a simplified stamp duty collection process for listed securities, bringing in a unified rate. From January 9, stock exchanges will collect the stamp duty for trading stocks and commodities on exchanges and depository will collect for any off-market transactions at a unified rate and deposit the proceeds with the central government, which in turn will divide it among the states.

The new stamp duty for equity delivery trades would be only on the buy-side of the transaction at 0.0.15 per cent or Rs 1,500 per crore. Currently, it is charged on both buy and sell trades.

For intra-day equity and options (equity and commodities) trades, the new stamp duty would be 0.003 per cent or Rs 300 per crore. For futures — equity and commodities — it will be 0.002 per cent or Rs 200 per crore and for currency, it will be 0.0001 per cent or Rs 10 per crore.

Stamp duty is charged per contract note and based on traded volume. Currently, brokers collect from clients and pay to the respective state governments.

“Active traders from Tamil Nadu, Goa, Daman & Diu will benefit from the new uniform stamp duty collection while traders based out of states where there was a maximum cap on the stamp duty per day like Haryana, Andhra Pradesh, Uttar Pradesh, Telangana and Odisha will be affected” said Nitin Kamath, founder of discount brokerage Zerodha. “It remains nearly unchanged for most other states like Maharashtra and Delhi”.

Most states collected stamp duty in the range of Rs 200 to Rs 300 per crore for intraday/derivatives. Some states like Andhra Pradesh, Assam, Haryana, Odisha, Telengana and Uttar Pradesh had a maximum cap per contract note. For instance, Andhra Pradesh currently charges stamp duty of 0.005 per cent or Rs 50 per contract whichever is maximum. Similarly, Uttar Pradesh charges 0.002 per cent or Rs 1,000 per contract whichever is maximum.

Several brokerages have been choosing their place of incorporation in destinations like Daman and Goa where the stamp duty rate is lower. For instance, Maharashtra collects a stamp duty of 0.01 per cent for delivery-based trades which is double of Daman’s 0.005 per cent slab. Bringing in a uniform rate will do away with such advantages.