Thousands of taxpayers get notices for minor defaults

Mridula stood shivering outside the magistrate court in Mumbai. It wasn’t the drop in temperature, but the thought that she could land in jail owing to a rigorous Income-Tax (I-T) provision, which did not look into the severity of her tax default. She had defaulted by 30-odd days on depositing TDS collected from her employees’ salary.

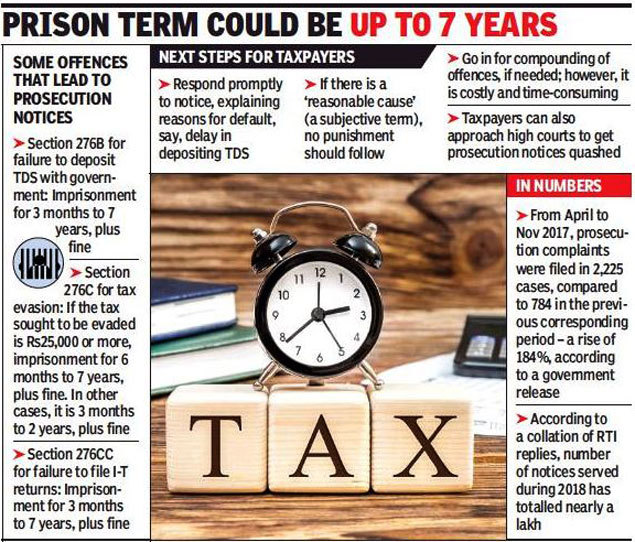

Her two-year-old content company has six full-time employees and deals with freelancers when there is a spike in work. Mridula was shocked to get a notice from the I-T department saying: ‘To show-cause as why prosecution under section 276B, read with section 278B of the I-T Act, should not be launched.’ The sections deal with failure to deposit TDS with government, and the maximum imprisonment is 7 years.

According to Mridula (name changed to protect identity), only four of her employees earned above the exemption limit of Rs2.5 lakh, and the delayed TDS (an insignificant sum) had been deposited by her within the financial year. In addition, details of chairman, managing director and directors were sought.

Meant primarily to tackle black money, I-T officials have lately been using the punitive provisions widely. TOI has examined many such notices issued over the past several months. According to a collation of RTI replies, the number of notices served to taxpayers in 2018 runs into thousands.

Even salaried employees have been served notices for delay or non-filing of I-T returns, states K Shivaram, senior advocate and past president of All India Federation of Tax Practitioners.

A slew of prosecution notices have been issued to small taxpayers by the Income-Tax department for what are seen to be minor violations under punitive provisions of the I-T Act.

To shore up revenue, Sushil Chandra, chairman, Central Board of Direct Taxes (CBDT), in a recent letter to his cadres (reported by TOI on January 6) called for filing of prosecution against persons who were wilfully evading payment of outstanding taxes and also for ‘substantial’ defaults in remitting TDS to the government. The CBDT’s action plan has also given targets to I-T officials for serving prosecution notices for TDS defaults.

Ameet Patel, a CA and chairperson of the taxation committee at the Bombay Chartered Accountants’ Society (BCAS), states, “For the smallest of defaults like late payment of TDS, late payment of self-assessment tax, delayed or non-filing of tax returns (including TDS returns), taxpayers are issued show-cause notices asking why prosecution proceedings should not be launched. Even a mere non-filing of appeal against any addition to income or disallowance of expenditure made during assessment is a ground for launching prosecution. Further, taxpayers are given a very short period within which to respond.”

Recently, BCAS, IMC Chamber of Commerce and Industry, and a few other CA associations across India filed a representation with revenue secretary Ajay Bhushan Pandey protesting against the use of prosecution provisions in a mechanical manner, with minor mistakes treated as major offences at par with large-scale evasion). They have said these actions vitiate the promise of a non-adversarial tax regime. Even as many other steps (such as e-assessment or speedy refunds) have been taken to benefit taxpayers, the spate of prosecution notices sends a bad signal, say tax experts. Even as so many other steps (such as Eassessment or speedy refunds) have been taken to benefit taxpayers, the spate of prosecution notices send a bad signal, say tax experts.

An I-T department official explains that the taxpayer must promptly respond to any notice if he or she has received any, explaining reasons for the default. If there is a ‘reasonable cause,’ say, for failure to deposit TDS, Section 278AA of the Act provides that punishment shall not be imposed.

The official agrees that the term ‘reasonable cause’ is not defined, but instances such as illness of self or close kin and financial difficulties, if supported by evidence, could be accepted.

In several instances, the I-T commissioner grants sanction to the I-T officer to launch prosecution proceedings and the officer files a complaint with the small causes court. “If the ‘defaulting’ taxpayer is a company, proceedings are launched on the company and all directors, including foreign directors, professional (independent) directors and the principal officer,” says Patel.

“Once prosecution is launched, taxpayers have to appear from time to time before the local magistrate court. It takes years for many matters to reach the final hearing stage. Magistrate courts are not able to deal with a number of matters that are filed indiscriminately. In many cases, the penalty has been deleted by the I-T appellate tribunal or by the high courts, yet the matter is not discharged. For effective implementation, it is desirable to have special courts, and AIFTP has made representations in this regard,” states K Shivaram.

Taxpayers can opt for the ‘compounding’ process. An application can be filed either before or after institution of the prosecution proceeding. The chief commissioner has the right to accept or reject the application.

Based on CBDT’s guidelines, it is generally believed that a taxpayer cannot approach the I-T authorities for compounding after one year of the launching of prosecution. Patel points to a Delhi high court decision of April 11, 2017 in the case of Vikram Singh. Analysing CBDT guidelines, the Delhi high court held that these do not prescribe a period of limitation for filing of an application for compounding with the tax authorities.

Compounding entails payment of the entire tax demand plus compounding fees. These fees are generally equal to taxes due, without any co-relation with the tax amount or delay involved and can cause financial pressure, and the process is timeconsuming. However, this could lead to the prosecution being dropped.