Buying non-resident’s flat? Check tax impact

Individuals who have purchased property from non-residents find themselves grappling with several income tax-related challenges. To begin with, it’s difficult to determine the seller’s tax status (whether he is a resident or non-resident in India according to the I-T Act). This is crucial, as tax is required to be deducted at 20 per cent (in come cases even higher) for property purchased from a non-resident, as opposed to 1 per cent where the seller is a tax resident.

In case of wrong deduction, penalties apply, and the buyer can face prosecution.

When property is purchased from a resident, according to section 194-IA, TDS obligations kick in only if the sale consideration is above Rs 50 lakh. In case the purchase is from a non-resident, according to section 195, TDS obligations apply in all cases irrespective of the quantum.

In its July 24 edition, TOI reported that the Central Board of Direct Taxes (CBDT) — in its action plan — asked I-T cadre to closely watch property purchases from non-residents. Following this, TOI received many emails from readers. The issues faced by them and action points are analysed in a two-part series.

How to identify if the seller is a non-resident?

Lay buyers often get confused between residency according to tax laws, and nationality. Pune-based advocate Harshal Jadhav says, “Typically, the non-resident seller does not reside in Pune, where the property is situated. Communication with the prospective buyers are largely via email or telephone. In some cases, the seller sends the property documents along with a PAN card or Aadhaar card and agrees to meet on a pre-fixed date to complete the sale. These cards mislead the buyer who is a layman. Even otherwise, unless clearly disclosed by the property seller, it becomes difficult to determine his residential status.”

What to do:

Anil Harish, an advocate specialising in real estate, says, “The first step is to directly ask the seller if he is a non-resident. One can also probe further and ask for his I-T returns or passport details to determine the number of days stayed in India during the relevant period. As sellers may be reluctant to share these documents, the prospective buyer could ask the seller to get a certificate from his chartered accountant of his being a tax resident in India. An undertaking in writing must also be obtained from the seller of his being a resident (this can be part of the sale deed or a separate document). But such declarations will not offer absolute protection.”

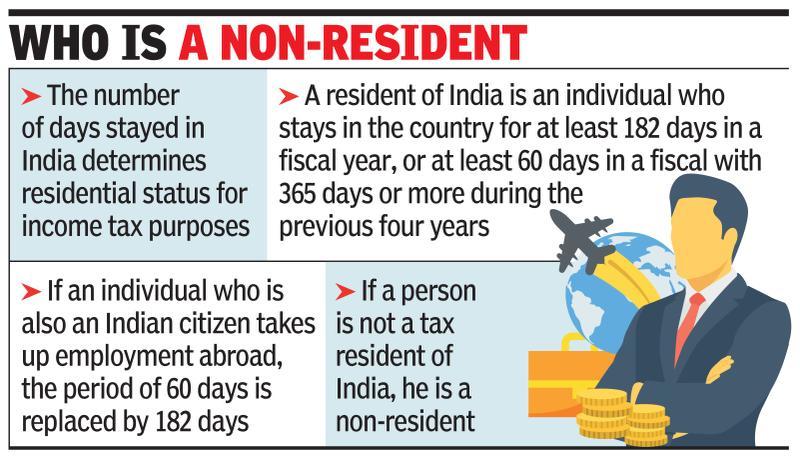

Typically, if the seller has given a power of attorney to someone else, it’s likely he is a non-resident, caution experts. KPMG India tax partner Parizad Sirwalla says, “Tax residency in India is determined based on the number of days the individual has spent in India in the relevant financial year as well as a look-back period of four financial years (see box). Stay details in India of the seller, such as copies of passport covering this period, should be obtained. However, if the transaction is carried out in the earlier part of the financial year, it is slightly difficult to determine residential status conclusively — here, a more conservative approach may be adopted by the buyer.”

Jadhav adds, “Buyers should get the agreement or sale deed verified by an advocate to safeguard their interests from disputes arising out of arrears of income tax liabilities, if any.”

TAN issues

In order to deduct tax at source, the buyer has to register online for TAN, but there is no process for its surrender. A reader says, “Mine was a one-time TDS obligation on purchase of a flat from a non-resident. Several years on, I still have to file a nil return each quarter and bear the costs of such filing.”

To do: Indore-based chartered accountant Shweta Ajmera says, “The buyer (deductor) can apply to the jurisdictional TDS officer, requesting cancellation of TAN. In the absence of any prescribed form, he can use a plain paper and give reasons for his request.”

Source : Click Here