Banks use ad hoc and arbitrary methods to keep lending rates inflated: RBI Study Group

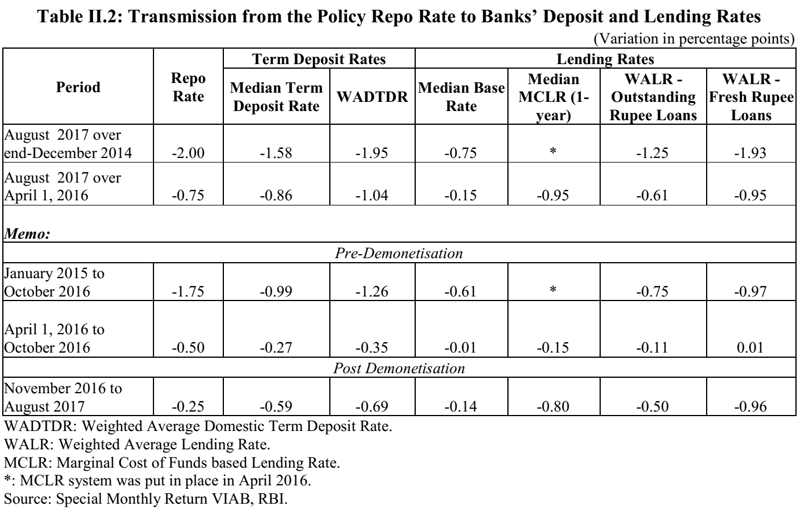

Exposing the ad hoc manner used by banks to deviate from specified methodologies for calculating base rate and marginal cost of funds based lending rate (MCLR), a Reserve Bank of India (RBI) study group had said that banks used this to either inflate base rate or prevent it from falling in line with the cost of funds. Also banks, both public sector and private, took almost six months to transmit reduction in MCLR to customers, says the report from an Internal Study Group of the RBI.

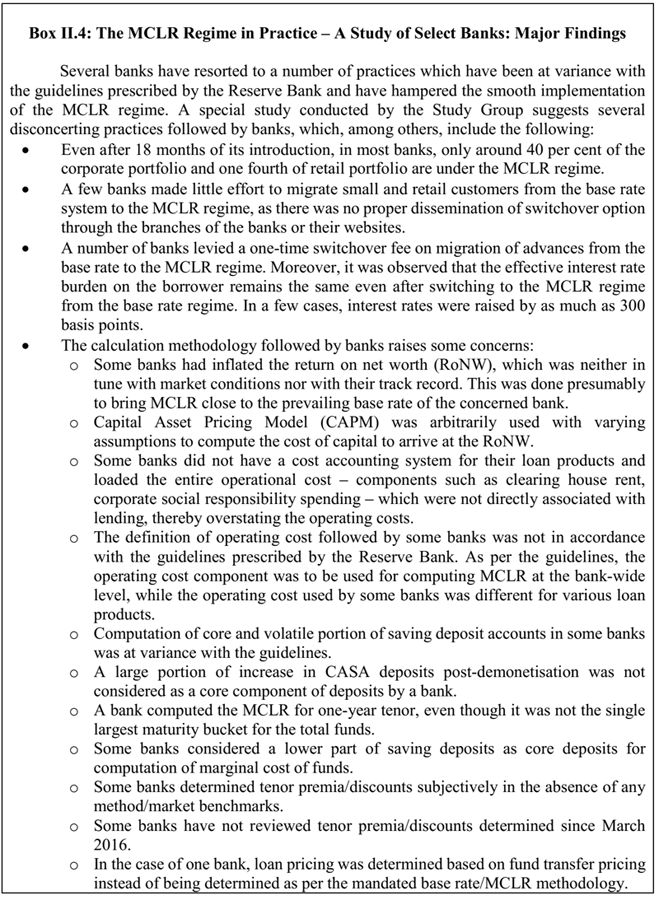

The Study Group was set up on 24 July 2017 to study the various aspects of the MCLR system from the perspective of improving the monetary transmission and exploring linking of the bank lending rates directly to market determined benchmarks. “The ad hoc adjustments used by banks, included inappropriate calculation of the cost of funds; no change in the base rate even as the cost of deposits declined significantly; sharp increase in the return on net worth out of tune with past track record or future prospects to offset the impact of reduction in the cost of deposits on the lending rate; and inclusion of new components in the base rate formula to adjust the rate to a desired level. The slow transmission to the base rate loan portfolio was further accentuated by the long (annual) reset periods,” the Report says.

According to the Dr Janak Raj headed Study Group, the one year reset clause used by banks impedes monetary transmission as pass through of monetary policy changes to existing floating rate loans. The Study Group has recommended reducing the reset period (for interest rates) to once in a quarter from once in a year on all floating rate loans, retail as well as corporate.

It says, “The transmission from the reduction in the MCLR to lending rates occurred with a lag. In the case of private sector banks, it took almost six months for the transmission from the lower MCLR to actual lending rates. However, in the case of public sector banks, the transmission was not complete even after six months.”

“In the absence of any sunset clause on the base rate, banks have been quite slow in migrating their existing customers to the MCLR regime. Most of the base rate customers are retail or small and medium enterprise (SME) borrowers. Hence, the banking sector’s weak pass through to the base rate is turning out to be deleterious to the retail and SME borrowers in an easy monetary cycle. To address this concern, besides immediate recalculation of base rates, banks may be advised to allow existing borrowers to migrate to the MCLR if they so choose to do without any conversion fee or any other charges for switchover on mutually agreed terms. However, after the adoption of an external benchmark from 1 April 2018 as recommended by the Study Group, banks may be advised to migrate all existing benchmark prime lending rate (BPLR), base rate and MCLR borrowers to the new benchmark without any conversion fee or any other charges for switchover on mutually agreed terms within one year from the introduction of the external benchmark, by end March 2019,” the Report says.

As per the Report, transmission to interest rates on outstanding rupee loans was significantly lower than on fresh rupee loans. It says, “The median spread in the case of outstanding rupee loans remained significantly higher than that of fresh rupee loans, reflecting the dominance of base rate loan portfolio in outstanding loans and lagged interest rate reset (normally one year) for

the existing borrowers under the MCLR system. Spreads on outstanding loans were also more volatile than those on fresh loans.”

“Spreads charged by private sector banks on fresh rupee loans were consistently the largest, followed by public sector banks and foreign banks. Spreads charged varied significantly across banks and also temporally. Spreads of foreign banks were relatively more volatile than those of public and private sector banks,” the Report says.

According to the Dr Janak Raj Study Group, there are four factors affecting monetary transmission. This includes, maturity mismatch and interest rate risk in the fixed rate deposits but floating rate loan profile of banks; rigidity in saving deposit interest rates; competition from other financial saving instruments; and deterioration in the health of the banking sector.

A major factor that impeded transmission was the maturity profile of bank deposits, the report says, adding, deposits with maturity of one year and above constituted 53% of banks’ total deposits at end-March 2016, most of which were at fixed rates of interest.

“Another source of weak transmission was rigidity in interest rates on banks’ saving deposits, which remained notoriously stubborn even as the policy repo rate and interest rates on term deposits moved in either direction. The third factor, which hindered monetary transmission was the competition that banks faced from other saving instruments. It appears that banks were reluctant to reduce interest rates sharply for fear of losing deposits to other financial saving instruments such as mutual funds and small saving schemes. Although bank deposits have some distinct advantages in the form of stable returns (vis-à-vis mutual fund schemes) and liquidity (vis-à-vis small saving schemes), bank deposits are in a disadvantageous position in terms of tax-adjusted returns in comparison with these schemes. Banks, therefore, often appeared to be reluctant to reduce interest rates on deposits in line with the reduction in the policy rate by the Reserve Bank. These factors imparted rigidity to the liability side of banks’ balance sheet,” it says.

The Report says as per empirical analysis, the extent of responsiveness of interest earnings and interest expenses to the changes in the policy repo rate is broadly the same, making the net interest margins (NIMs) impervious to monetary policy changes. “The deterioration in the health of banking sector and the expected loan losses in credit portfolios induced large variability

in spreads in pricing of assets, severely impacting monetary transmission as banks’ NIMs have remained broadly unchanged in the face of large stressed assets. Thus, rigidities on the liability side such as longer-term maturity pattern of deposits with fixed interest rates, along with the expected loan losses on the asset side, have been reflected in higher pricing on the asset side, or lending rates,” it added.

The Study Group also recommends to make it mandatory for banks to display prominently in each branch the base rate and MCLR (tenor-wise) and the weighted average lending rates on loans across sectors separately for loans linked to the base rate and the MCLR. The same information should also be hosted prominently on each bank’s website. It suggest that RBI to prescribe format and manner in which a minimum set of standardised data needs to be displayed in branches and hosted on banks’ websites.

The Study Group also observed that internal benchmarks such as the base rate and MCLR have not delivered effective transmission of monetary policy. “Arbitrariness in calculating the base rate and MCLR and spreads charged over them has undermined the integrity of the interest rate setting process. The base rate and MCLR regime is also not in sync with global practices on pricing of bank loans. The Study Group has, therefore, recommended a switchover to an external benchmark in a time-bound manner,” the Report says.

In July 2010, the RBI introduced base rate system to ensure that the banks do not lend below a certain benchmark. However, from 1 April 2016, the base rate system was replaced by MCLR that comprises marginal cost of funds, negative carry because of cash reserve ratio (CRR), operating costs, and tenor premium. Any change in key reference rates such as the repo rate, brings about changes in the marginal cost of funds and affects the MCLR. The MCLR prevailing on the date of first disbursement (whether partial or full) remains applicable till the next reset date, irrespective of the changes in the benchmark during the interim period.